Wolfe Waves are a reliable pattern used in technical analysis to predict future price movements. This method was developed by Bill Wolfe, who noticed that certain wave patterns frequently precede price reversals. These patterns can be identified in any market and timeframe, making them a versatile tool for traders. Wolfe Waves are similar to Elliott Waves but focus more on symmetry and equilibrium, which are key to their predictive power.

Historical Context and Development of Wolfe Waves

Wolfe Waves have their roots in the broader field of wave theory and technical analysis, particularly drawing inspiration from Elliott Wave Theory. Developed by Bill Wolfe, the Wolfe Wave pattern builds on the concepts of natural balance and equilibrium in price movements. Unlike the more complex Elliott Wave Theory, Wolfe Waves focus on symmetry and predictable price targets, making them more accessible to a wide range of traders.

Bill Wolfe’s observations stemmed from years of studying market behavior, where he noted recurring patterns that preceded significant price reversals. He discovered that these patterns formed a distinct five-wave structure, which could be used to forecast future price movements with a high degree of accuracy. His methodology was further refined and popularized through his teachings and writings, making Wolfe Waves a staple in many traders’ analytical toolkits.

The development of Wolfe Waves is a testament to the continual evolution of technical analysis. As traders seek more reliable and straightforward methods to predict market movements, the simplicity and effectiveness of Wolfe Waves have stood the test of time. Today, they are widely recognized and used in various financial markets, including Forex, stocks, and commodities.

Identifying Wolfe Waves

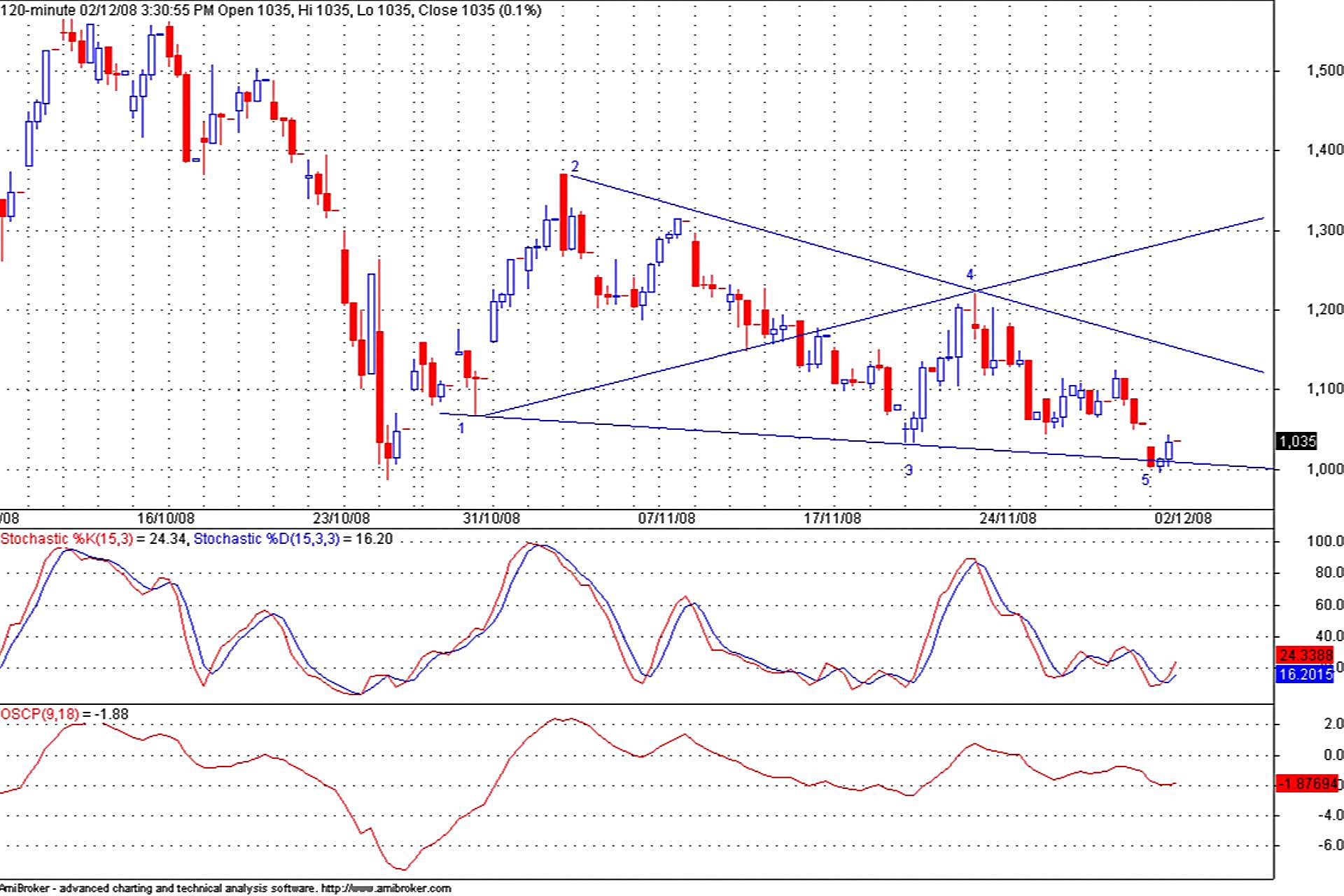

Identifying Wolfe Waves on a price chart involves a systematic approach to locating the five key points that define the pattern. The first step is to find the initial wave (point 1 to point 2), which sets the stage for the subsequent waves. This wave is typically characterized by a significant price move that captures the market’s attention. Once point 2 is established, traders should look for a corrective move to point 3, which generally retraces a portion of the initial wave.

Points 4 and 5 are the next critical points to identify. Point 4 should ideally fall within the price range of points 1 and 2, forming a symmetrical pattern. The final point, point 5, is where the price is expected to reverse. This point is crucial as it offers the optimal entry for a trade, with the expectation that the price will move towards the sweet zone target line.

For better clarity, here’s a breakdown of the process in a tabular form:

| Point | Description | Key Characteristics | Importance |

| 1 | Start of the initial wave | Significant price movement | Sets the initial stage for the Wolfe Wave |

| 2 | End of the initial wave | End of the price move from point 1 | Defines the first major high or low |

| 3 | Corrective wave | Partial retracement of the wave from point 1 to 2 | Helps to establish symmetry |

| 4 | Preceding the final wave | Falls within the range of points 1 and 2 | Critical for forming the converging wedge |

| 5 | Optimal entry point for the trade | Expected price reversal point | Key to executing a successful Wolfe Wave trade |

Using this table, traders can systematically identify and confirm Wolfe Wave patterns, ensuring a disciplined and methodical approach to trading.

Trading Strategies with Wolfe Waves

Wolfe Waves offer a structured approach to trading Forex, focusing on specific price patterns that indicate potential reversals. Here’s a breakdown of effective trading strategies using Wolfe Waves:

- Identify the Wolfe Wave pattern: Start by locating points 1 to 5 on a price chart, ensuring each point adheres to the pattern’s symmetry and positioning rules.

- Enter at point 5: This is the optimal entry point where the price is expected to reverse. Place a trade at this point with a stop-loss just beyond point 5 to manage risk.

- Set a target at the sweet zone: Use the line connecting points 1 and 4 as a target for taking profits. This line indicates where the price is likely to reach after the pattern completes.

- Manage the trade: Monitor the trade closely once entered. Adjust stop-loss levels and consider scaling out of the position as the price approaches the sweet zone.

Trading with Wolfe Waves requires discipline and a keen eye for patterns. By adhering to these strategies, traders can capitalize on potential price reversals effectively.

Benefits and Challenges of Wolfe Waves

Wolfe Waves offer several benefits to Forex traders. One of the primary advantages is their ability to predict price targets with high accuracy. This predictive power stems from the inherent symmetry and equilibrium in the patterns, which reflect the natural market forces at play.

By leveraging these patterns, traders can gain a significant edge in the market. Another benefit is the versatility of Wolfe Waves.

They can be applied across various timeframes and market conditions, making them suitable for both short-term and long-term trading strategies. This adaptability allows traders to use Wolfe Waves in conjunction with other trading methods, enhancing their overall trading toolkit.

Overcoming the Challenges

To harness the benefits and mitigate the challenges of Wolfe Waves, traders should:

- Practice Regularly: Continuous practice in identifying and trading Wolfe Waves is crucial. Reviewing historical charts and participating in trading simulations can help refine skills.

- Utilize Additional Indicators: Incorporating other technical analysis tools, such as moving averages or RSI, can provide additional confirmation and reduce the risk of false signals.

- Educate Continuously: Staying updated with market trends and developments, as well as learning from trading communities and resources, can enhance a trader’s knowledge and proficiency.

- Maintain Discipline: Developing and adhering to a structured trading plan is essential. This includes setting clear entry and exit rules, risk management strategies, and avoiding emotional trading decisions.

By understanding the benefits and addressing the challenges associated with Wolfe Waves, traders can effectively incorporate this powerful tool into their Forex trading strategy. Mastering Wolfe Waves requires dedication and practice, but the potential rewards in terms of accuracy and profitability make it a valuable addition to any trader’s toolkit.

Example of a Wolfe Wave Trade

Consider a scenario where a Forex trader identifies a Wolfe Wave pattern on a daily chart of the EUR/USD currency pair. The trader confirms the pattern’s validity by ensuring the waves align correctly and form a converging wedge. The entry point is at point 5, with a stop-loss placed just beyond this point. The trader sets a price target at the sweet zone line, connecting points 1 and 4.

As the trade progresses, the price begins to move towards the sweet zone, validating the pattern. The trader takes partial profits along the way and adjusts the stop-loss to protect gains. Once the price reaches the target, the trader exits the remaining position, completing a successful Wolfe Wave trade.

By following these steps, traders can systematically apply Wolfe Waves in their Forex trading strategies, enhancing their ability to predict market movements and achieve consistent profitability. The practical application of Wolfe Waves requires discipline, patience, and continuous practice, but the rewards can be substantial for those who master this powerful analytical tool.