Forex (foreign exchange) trading involves the buying and selling of currencies on the foreign exchange market. Traders seek to profit from changes in currency exchange rates, which are influenced by a variety of factors. Traditionally, forex analysis relies on two primary methods: fundamental analysis and technical analysis. Fundamental analysis examines economic indicators, geopolitical events, and market sentiment, while technical analysis focuses on price charts and patterns. However, as the global economy evolves, it’s becoming increasingly important to consider environmental factors in forex analysis. Copy trading, where investors automatically replicate the trades of successful traders, is gaining popularity as a method to leverage market knowledge and potentially improve trading results.

Read moreCategory: Blog

Your blog category

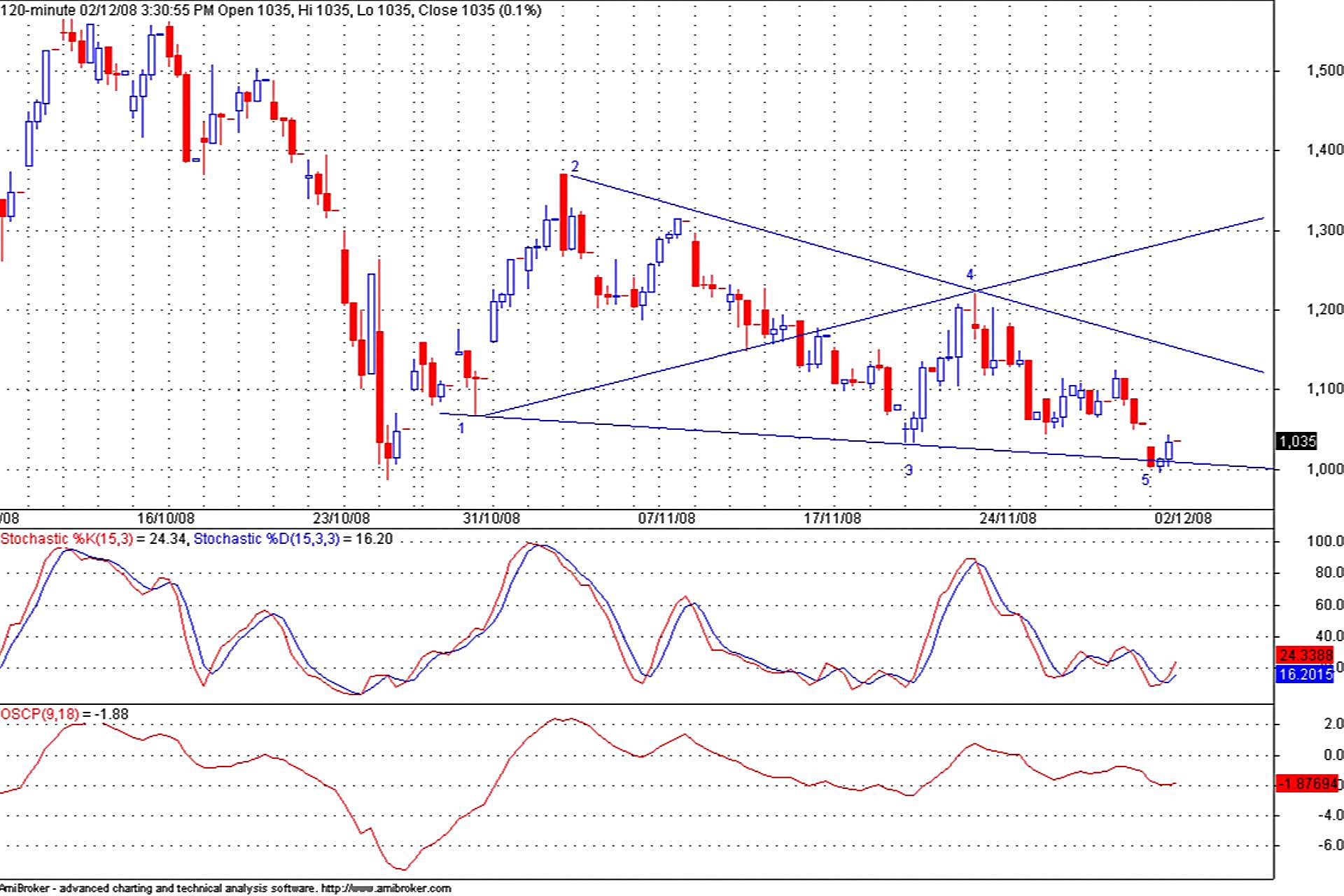

Forex Trading with Wolfe Waves

Wolfe Waves are a reliable pattern used in technical analysis to predict future price movements. This method was developed by Bill Wolfe, who noticed that certain wave patterns frequently precede price reversals. These patterns can be identified in any market and timeframe, making them a versatile tool for traders. Wolfe […]

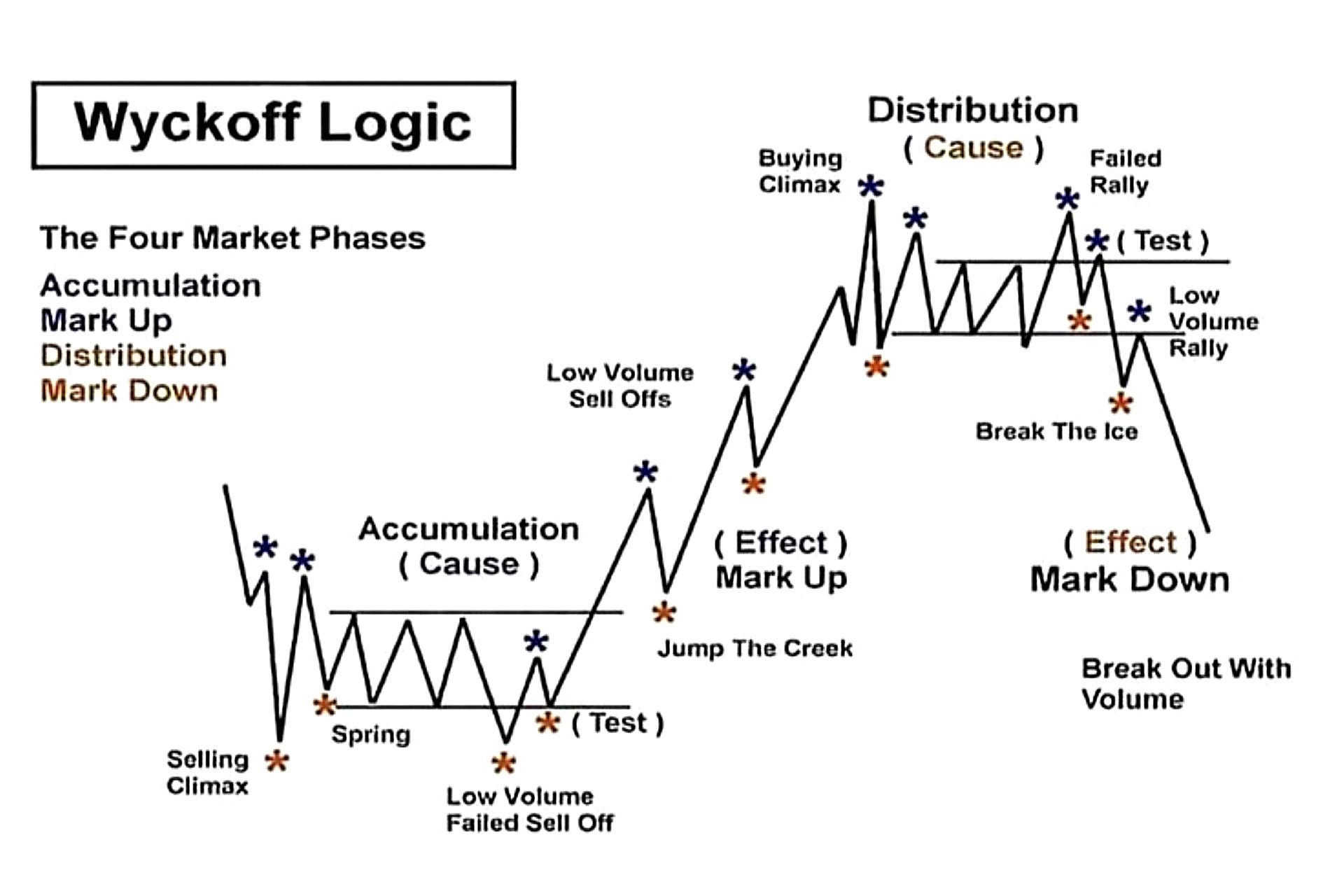

Read moreIntegrating Wyckoff Method in Forex Trading

The Wyckoff Method, developed by Richard D. Wyckoff in the early 20th century, is a sophisticated technical analysis tool used by traders to identify market trends and make informed trading decisions. Initially applied to the stock market, its principles are highly relevant to the Forex market as well. The method […]

Read moreThe Influence of Seasonal Affective Disorder on Market Behavior

Seasonal Affective Disorder (SAD) is a type of depression that occurs at a specific time of year, usually in the winter. It can affect anyone, but it’s more common in regions with long winter months and limited sunlight. The implications of SAD extend beyond personal health and well-being, influencing various […]

Read moreForex Trading with Gann Theory

Gann Theory, developed by the legendary trader William D. Gann, is a technical analysis approach that aims to predict price movements in financial markets. Gann believed that price and time are interrelated and that their relationship can be used to forecast future price movements. This theory is grounded in various […]

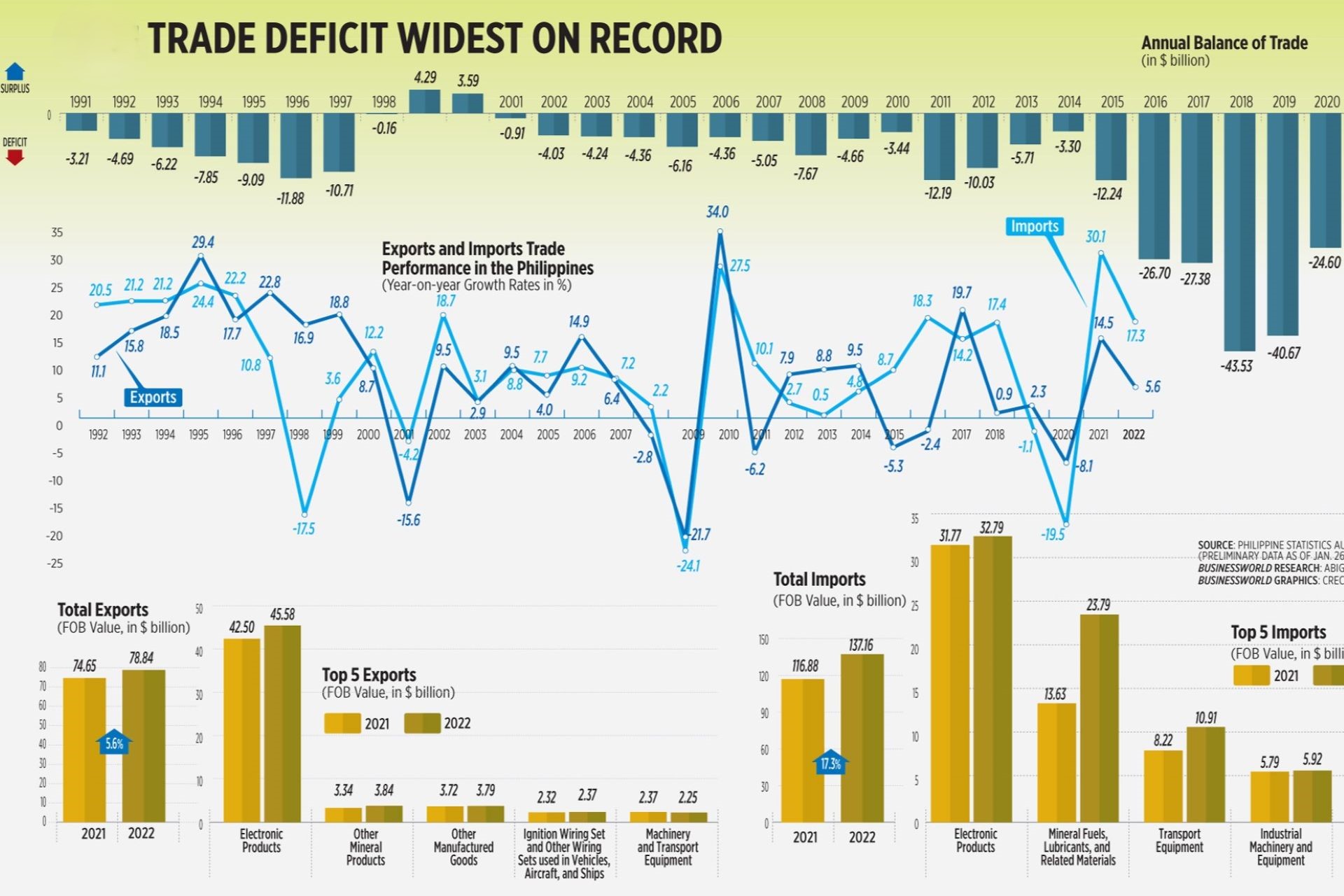

Read moreThe Significance of Trade Deficits in Forex Analysis

Understanding the significance of trade deficits in forex analysis is crucial for anyone involved in currency trading or economic forecasting. Forex, or foreign exchange, markets are dynamic and influenced by various economic indicators, among which trade deficits play a pivotal role. But what exactly is a trade deficit, and why […]

Read more