Understanding the significance of trade deficits in forex analysis is crucial for anyone involved in currency trading or economic forecasting. Forex, or foreign exchange, markets are dynamic and influenced by various economic indicators, among which trade deficits play a pivotal role. But what exactly is a trade deficit, and why does it matter in forex analysis? Let’s delve into this topic to uncover the profound impact trade deficits have on currency values and the broader economy.

Understanding Trade Deficits

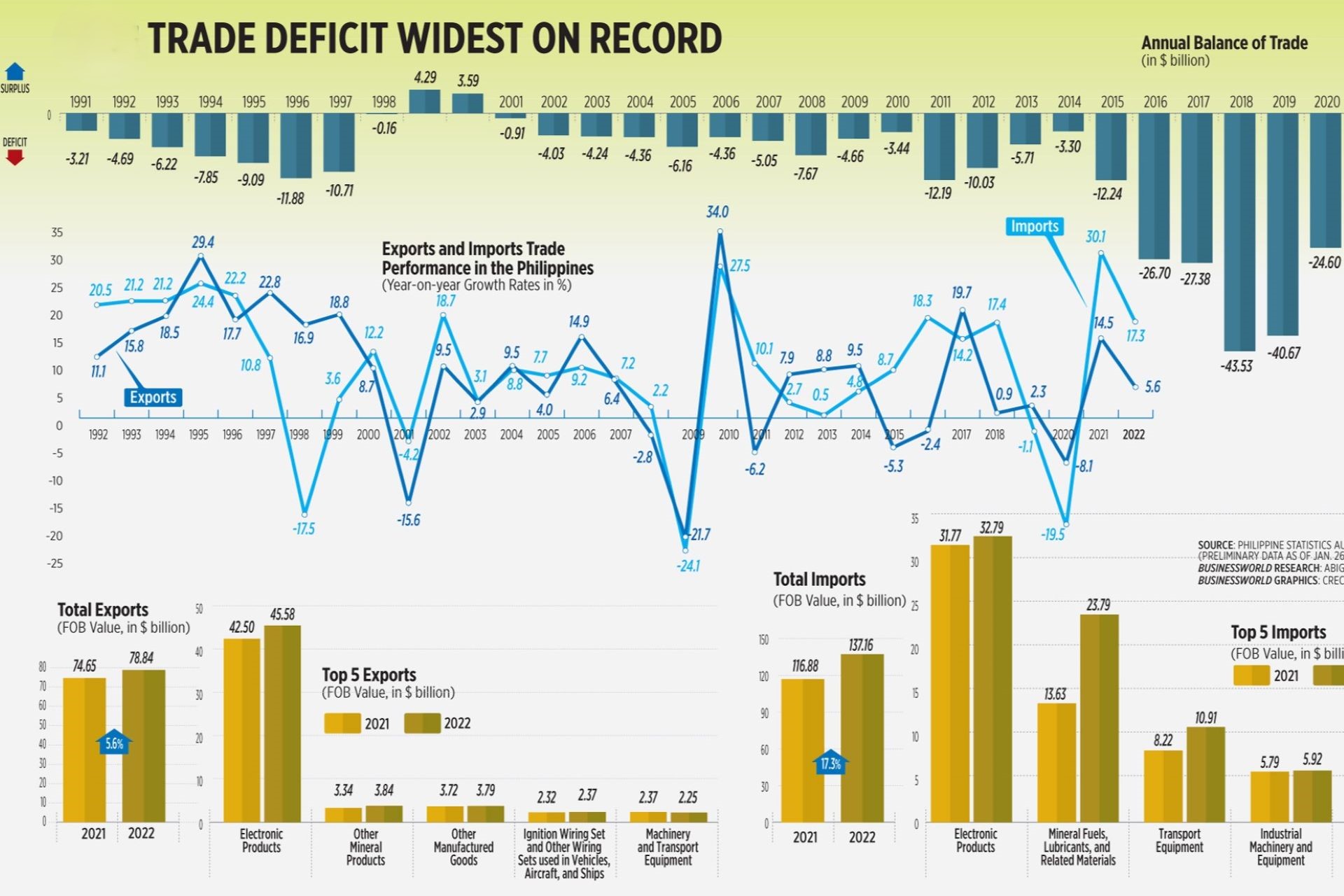

A trade deficit occurs when a country imports more goods and services than it exports. This imbalance means that more money is leaving the country to pay for these imports than is coming in from exports. Trade deficits are often viewed negatively, but they can be caused by various factors, including a strong domestic currency, high consumer demand for foreign goods, and low production capacity within the country.

To better grasp the concept, consider the following table that illustrates the trade balance of three hypothetical countries over a fiscal year:

| Country | Exports (in billions) | Imports (in billions) | Trade Balance |

| Country A | 500 | 700 | -200 |

| Country B | 600 | 600 | 0 |

| Country C | 400 | 300 | +100 |

From the table, Country A has a trade deficit of 200 billion, Country B has a balanced trade, and Country C enjoys a trade surplus.

Historical Context of Trade Deficits

Historically, trade deficits have had varying impacts on economies. For instance, the United States has experienced significant trade deficits for decades, primarily due to its high consumption rates and reliance on imported goods.

While some argue that these deficits indicate economic weakness, others point out that they can also reflect a strong economy with high consumer purchasing power.

In contrast, countries like China have historically maintained trade surpluses, which have bolstered their foreign exchange reserves and strengthened their economic position globally. The differing experiences of these countries offer valuable lessons on the multifaceted nature of trade deficits.

The Role of Trade Deficits in Forex Markets

Trade deficits are critical in forex markets because they influence currency values. When a country runs a trade deficit, it typically needs to sell its currency to buy foreign currencies to pay for imports. This increased supply of the domestic currency can lead to depreciation. For example, if the US has a significant trade deficit, the value of the USD might decrease relative to other currencies.

Investor sentiment is another factor influenced by trade deficits. Large and persistent deficits may cause investors to lose confidence in a country’s economic stability, leading to capital flight and further depreciation of the currency.

Conversely, if a country with a trade deficit shows signs of economic improvement, such as increased exports or reduced imports, investor confidence might be restored, stabilizing the currency.

Economic Indicators Related to Trade Deficits

Several economic indicators are closely related to trade deficits, providing valuable insights into a country’s economic health:

- Balance of Payments (BoP): This comprehensive record includes the trade balance, capital flows, and financial transfers. A deficit in the BoP can indicate economic problems.

- Current Account: A significant component of the BoP, it includes trade balance, net income from abroad, and net current transfers.

- National Debt: Persistent trade deficits can contribute to an increase in national debt, as countries borrow to finance their excess imports.

Understanding these indicators helps analysts predict how trade deficits might impact currency values and overall economic stability.

How Trade Deficits Affect Currency Valuation

The impact of trade deficits on currency valuation occurs through several mechanisms. When a country imports more than it exports, it must use its currency to buy foreign goods, increasing the supply of its currency on the forex market and leading to depreciation.

This process can have both short-term and long-term effects. In the short term, a sudden increase in imports can cause a rapid decline in currency value.

For example, if a country suddenly starts importing a large amount of oil due to a domestic shortage, its currency might quickly depreciate. In the long term, persistent trade deficits can erode investor confidence, leading to a more sustained currency devaluation.

Trade Deficits and Government Policy

Government policies play a crucial role in managing trade deficits. Fiscal policies, such as taxation and government spending, can influence a country’s trade balance.

For instance, reducing taxes on exports can make domestic goods more competitive abroad, potentially reducing a trade deficit. Monetary policies, including interest rates and money supply control, also impact trade deficits.

A country might devalue its currency to make exports cheaper and imports more expensive, thus addressing a trade deficit. Trade agreements can further influence trade balances by removing barriers and encouraging exports.

Analytical Tools for Trade Deficit Assessment

Various analytical tools help assess trade deficits and their impacts. These include:

- Economic Models: Used to simulate different scenarios and predict outcomes.

- Statistical Analysis: Helps identify trends and correlations.

- Data Sources: Reliable data from government agencies and international organizations is crucial.

Applying these tools enables forex analysts to make informed predictions and develop strategies for managing the effects of trade deficits.

Impact of Trade Deficits on Domestic Economies

Trade deficits can have significant impacts on domestic economies, influencing employment, wages, and overall economic health.

For example, persistent deficits might lead to job losses in manufacturing sectors due to increased competition from imports. This, in turn, can affect wages and reduce consumer spending.

On the flip side, trade deficits can also lead to increased foreign investment, creating jobs in other sectors and boosting economic growth. The net impact often depends on a country’s ability to adapt and respond to changing economic conditions.

Future Trends in Trade Deficits and Forex Analysis

Looking ahead, several trends are likely to shape the future of trade deficits and forex analysis. These include:

- Technological Advancements: Improved data analysis tools and real-time data access will enhance forex analysis.

- Globalization: Ongoing global trade integration will continue to influence trade balances.

- Policy Changes: Evolving trade policies and agreements will impact trade deficits and currency values.

Staying informed about these trends is essential for anyone involved in forex markets or economic forecasting.

In conclusion, trade deficits play a critical role in forex analysis, influencing currency values, investor sentiment, and economic stability. Understanding the causes and effects of trade deficits, as well as the tools used to analyze them, is essential for making informed decisions in the forex market. By keeping an eye on economic indicators, government policies, and global trends, analysts can better predict and respond to the impacts of trade deficits.